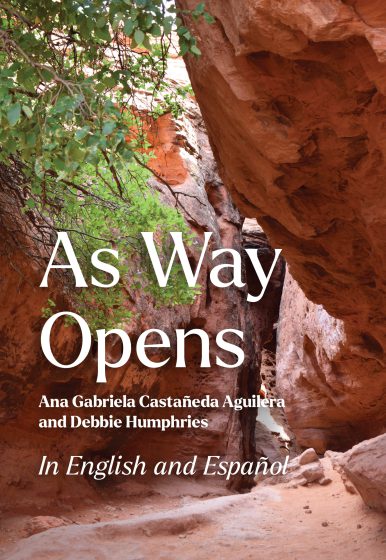

“When the path ahead suddenly clears, will you be ready to step forward?”

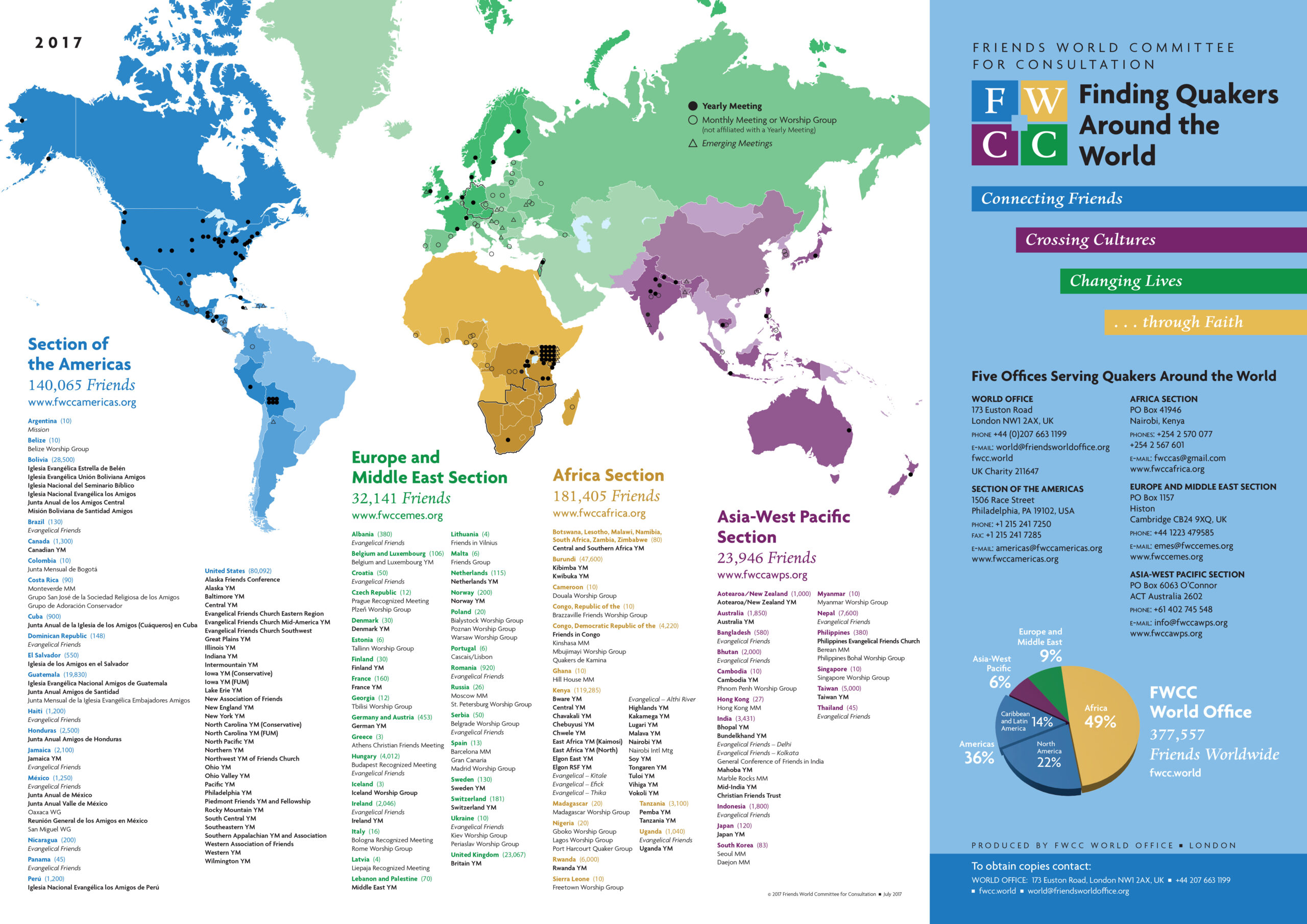

We are pleased to announce the publication of As Way Opens, a new collection of spiritual reflections born out of the FWCC Section of the Americas meeting in Scottsdale, Arizona, March 2025. This book is the first product of our newly formed partnership with Barclay Press, working together to bring Quaker voices into greater circulation.

What is "As Way Opens?"

In these talks — given by Ana Gabriela Castañeda Aguilera and Debbie Humphries — two Quaker-rooted voices invite us into deeper reflection on “way opening” moments. They share stories and insights about listening, discerning, and preparing for times when the Spirit invites us to act. Through their wisdom we are reminded that preparation is not passive waiting, but an ongoing cultivation of courage, clarity, and openness.

As the back cover describes:

We believe this work will speak to Friends and seekers alike — to those who reflect on times of transition, pivot, or call, and to those longing for guidance on how to walk faithfully when the path ahead is uncertain.

How donors can receive a copy

Because this is a special publication, we are making As Way Opens available as a thank-you gift to those who support FWCC with a donation of US $50 or more. Donors at or above that level will receive a mailed copy of the book, along with a note of thanks and our hopes that it will serve as spiritual support in their journey.

If you are interested in receiving a copy through your donation, please click the button below.